3/13 - 3/17 SPY Weekly Trade Plan

Big week ahead!

Readers,

Crazy end of the week last week and our weekly plan hit its downside target and then some with the help of the Silicon Valley Bank news.

The weekly high (407.45) was also one of our upside levels (405.50), it was hit on Monday and we trended down the rest of the week. Here is a link to last Sundays plan if you want to go review it.

—Weekly Pre-Plan—

Lets start off by reviewing the volume profiles. First we look at the monthly profile, we finally took out that January POC and VAL that we have been tracking now for a few weeks. We are currently at a monthly imbalance to the downside and our VAL sits at 390.80 and we closed at 385.91. So the bulls need to take back that VAL. If we stay under 388.60 we should move towards 375.

When we look at the weekly volume profile we can fine tune the levels. Last weeks VAL is sitting at 388.71 (this is roughly were January's POC was at). You can see that last week was very one sided, if the bulls can reclaim the VAL we can maybe rotate back up to 398.31-403.29. Under 384.11 we can look for a move down to 379.83-378.86.

I went ahead and found the key supply and demand levels based on these charts.

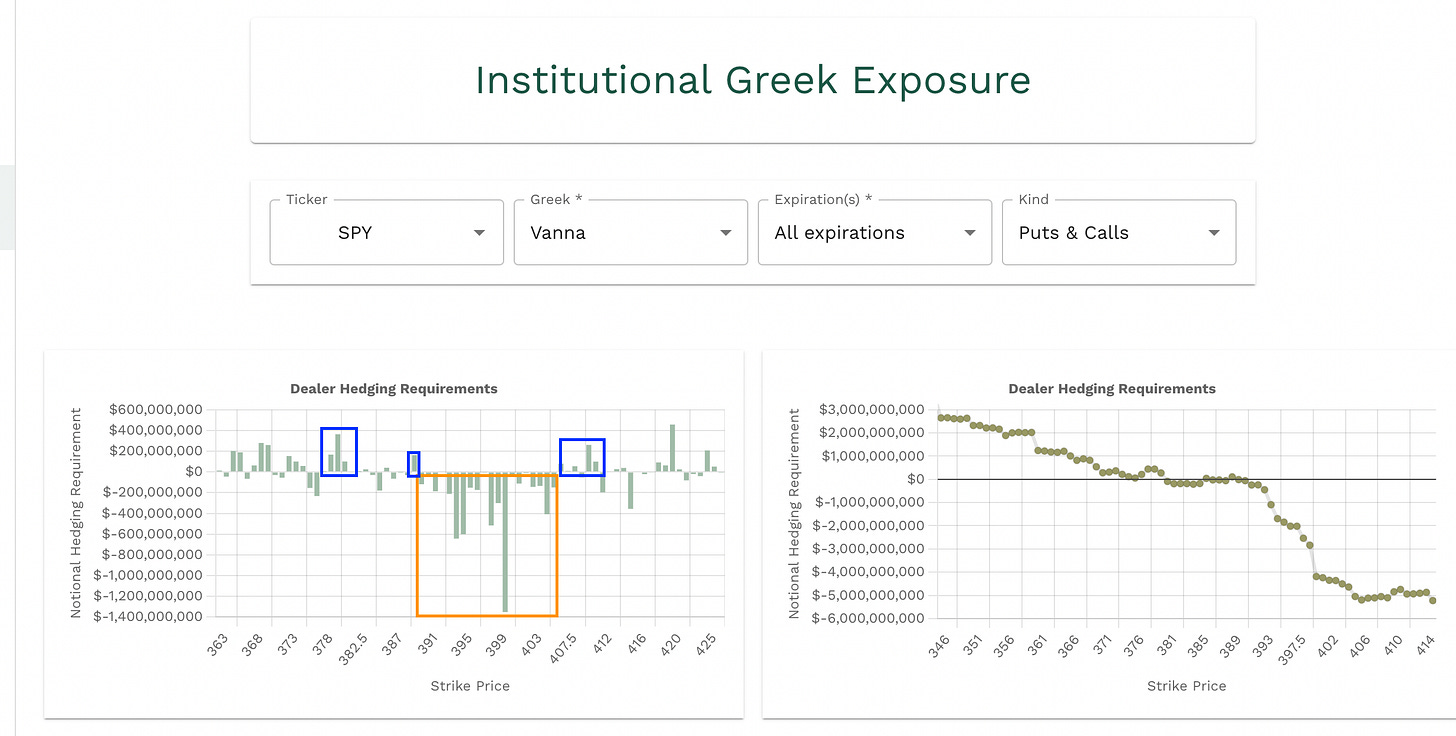

Now we dig into the Volland data to see if we can get some conviction with these levels. First looking at the aggregate vanna we can see that we have a bigger cluster of negative vanna from 390 to 406, and positive vanna at 389, with positive clusters around 380 and 410. This is saying that we might have a hard time getting up above 390 and back into 400, in order for this to happen we need to have big time IV crush (News will help this).

We also have some areas that could be stronger support at 387-385 and 377-376 these are areas of notable negative vanna.

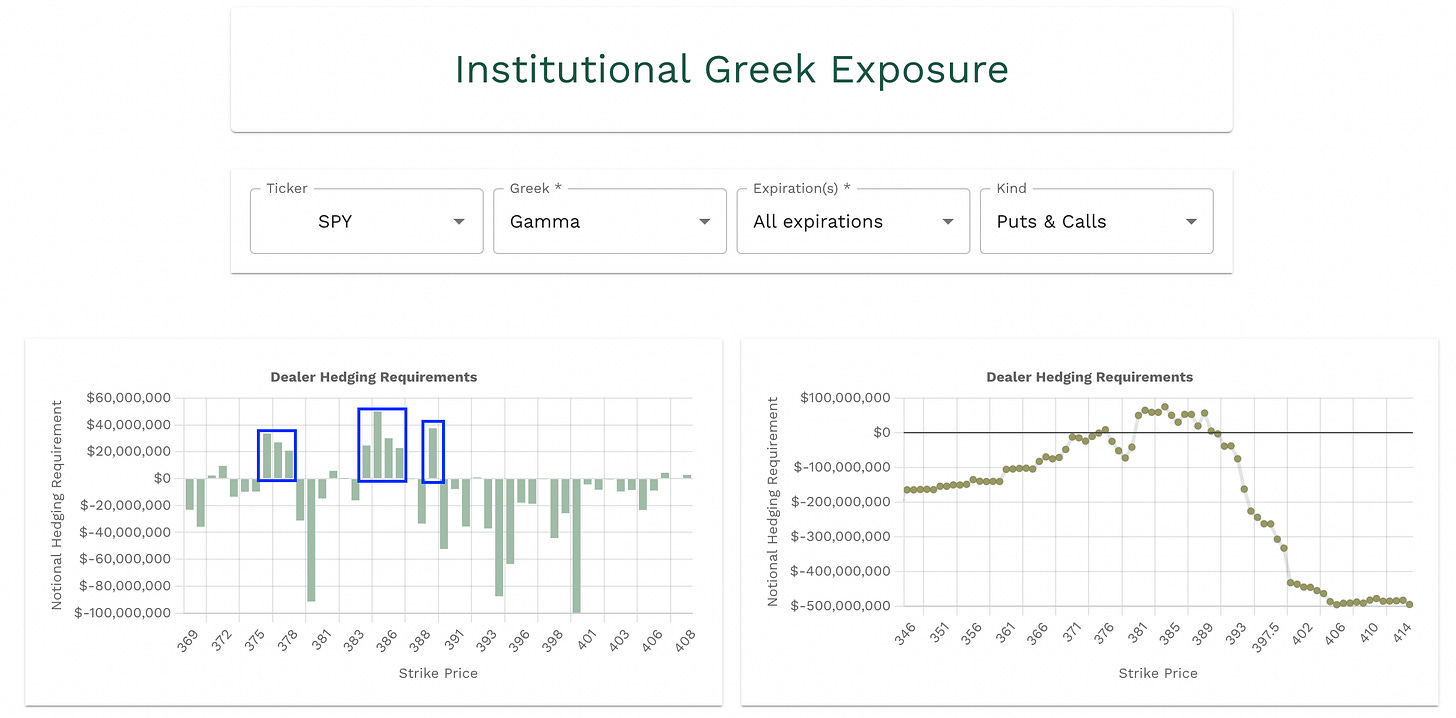

Now lets look at what gamma might be telling us, 389 is positive and then above that it is negative, 387-384 is positive meaning the bears have some work to do if they want to get us down under 385-384, this area could be strong support its positive gamma and negative vanna. If we push above 389-390 we can have a potential squeeze to the upside.

The market makers are expecting a weekly move of $11.86, this puts us around 397.77 or 374.05, both of these are major supply and demand zones based on our charting above.

—Weekly Trade Plan—

Bullish Scenario

Above 385 target 386.80 - 388.75

389 is positive gamma and negative vanna this area could be stronger resistance and it can also turn into strong support, keep that in mind!

Above 389 target 390.30-391.37

The negative vanna here is going to make it hard at current IV levels to continue higher, we need a vol crush if we are going to push up.

After 391.37 target 393-394.34, 395.24, 397.33-397.77, 399.21-400.58 we could also see 403-405 (I will keep you all updated as the week goes on)

Bearish Scenario

Below 384 target 382.93 - 381.50

The vanna at 385 is negative, so above 385 it should be supported, but under 385 it turns into resistance, and the positive vanna becomes a magnet from 381-379.

Below 381.50 target 380.50-379.85, 379-377.70

377-376 is negative vanna and positive gamma, we will look at this level for potential support.

Under 376 target 374.74-373.50

At the time of this post the market got some news about the banking situation and SPY is currently trading at 392.15 at the current ES levels around 10pm CST. These levels once resistance can create support. This week is going to be a fun one. I will have a new post for you each and every night with the updated levels.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.