December 28, 2023 SPX, SPY, ES Trade Plan

Market Recap

A choppy sideways action kind of day today…We opened within a trade idea where it hit the target and then sold off and throughout the day we found support near 4770 and 4782 all day.

If there is a failed breakdown of 4765 target 4775-4780

I mentioned those going long at 4780 were at risk and we had fake breakouts of this level. Clearly we know this zone is full of sellers still. It is why the bulls have been consolidating and breaking the wall at these resistance zones little by little.

Above 4786 target 4805

You could front this trade if price gets and holds above 4780, but be careful of reversals if it doesn’t hold

As we mentioned multiple times this week is all about paytience…sitting back on your trades and letting them work. Take profits where you feel comfortable and load back up. I have been comfortable scaling into swings. I have added yesterday and today with next week expiry and 1/19 (Jan OPEX) options. I am targeting ATH’s and that 4820 level.

For those who haven’t subscribed this is a great opportunity to subscribe.

For as little as $15/month we provide daily trade plans for intraday traders and also provide great educational content.

In good news dealer total aggregate Vega is now negative. For the past week or so the total notational value of Vega was positive - as high as $455b at one point before Wednesday’s selloff. When this is positive it means dealers are losing money and they don’t want to be in this position - they need to sell in other words. Looking at the historical data in Volland when this happens and you have a low volume liquidity situation like we did last week the dealers aggressively participate in the selloff to release or call it reduce the bloat on their balance sheets…This is why spot-vol or the VIX as it went down the past few sessions the move in the SPX was very minimal. Today was a great example of this.

Now that we are back to a negative total notional value in Vega the typical SPX-VIX correlation is back - VIX goes down and SPX goes up and vice versa. Additionally, this allows for expansion of the trading range.

News Catalysts

8:30am est - Unemployment Claims

8:30am est - Retail Inventories

10:00am est - Pending Home Sales m/m

11:00am est - Crude Oil Inventories

1:00pm est - 7-Year Note Auction

For more information on news events, visit the Economic Calendar

12/28 - SPX/ES/SPY Trade Plan

Bullish bias:

If there is a failed breakdown of 4786 target 4805

Even if we open at 4788 or 4790 long it and ride this one with a stop loss at 4780 or at break even depending on your risk management

Above 4805 target 4820

Stay close to the chat room for updates on 0DTE options flow - they could mess around with us and push to all-time highs on the last session of the year

If VIX continues going down then a breakout of 4820 targets 4830

Stay close to the chat room if we squeeze above ATH’s a bit more…

If there is a failed breakdown of 4775-4780 target 4795-4800

Select the 478 or 480 call with at least 1-2 weeks expiry if not 1/19 OPEX calls

If you wanted to play a lotto - do a 477 or 478 for Friday expiry

Bearish bias:

If there is a failed breakout of 4805 target 4790

Below 4790 target 4780

If VIX continues going up then a breakdown of 4775 targets 4765

Be careful here. If this trades below 4775 and you short it and it starts to come back above then 4780 should be your max stop loss

As always keep an eye on Volland30 and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 52pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.03.

SPX/ES/SPY Swing Trade Idea:

At this point go long targeting 4820 into January…I hope I have beat this into your trade plan by now…

If there is a failed breakdown of 4780 target 4820

Select the 480 call with at least 1-2 weeks expiry if not 1/19 OPEX calls

I am going to take the below trade idea off as I don’t believe we will get back to these levels to target this trade. Sharing update here for reference.

If 4745-4720 trades go long with expiration 2/16 or 3/15 475, 480, or 485 calls

I think if 4745-4735 trades this is the ideal zone to start accumulating calls

Should we trade near that 4720 level and it holds we can scale into more contracts at that point

12/28 SPX/SPY/ES Intraday Overview (TL;DR)

4775-4786 - Same zone as yesterday - we need to break and hold it for further continuation. So far in futures action we have gotten past this zone and tests of it have been defended. Keep an eye on it to act as support if we trade back towards these levels.

As long as we stay above 4786 the bulls will push price to 4805. It is here where it gets interesting. Are they going to push this further to hit all-time highs or are we going to see that in Friday’s session - the last session of the year? Ahhh the drama…

In either case - 4820 - trades above 4805 and gets us our all-time high banner… Now everyone will want to short there so wait - this may overshoot to 4830.

On the bear side defend 4805 and you may be able to chop price back towards 4790 and then 4780. The lowest I see us going is maybe 4775 so be careful with puts especially closer to expiry as there is a bit of liquidity issues there - spreads are wide and premiums are just not moving as buyers are hard to find to short…

SPX - The Why Behind the Plan

Key Levels Overview

4775-4786 - Same zone as yesterday - we need to break and hold it for further continuation. So far in futures action we have gotten past this zone and tests of it have been defended. Keep an eye on it to act as support if we trade back towards these levels.

4805 - You get above 4786 and this level comes, but the eye on the price continues above this level to target all time highs…To play it safe you could go long once we clear 4808, but have your orders ready as it could rip fast once through there…

4820 - this is what the bulls are after - they would want more but this is the goal…reach all time highs just like NQ/QQQ have. Exact all time highs are 4818.

4770-4765 - this level continues to play a critical zone for bulls to defend. This is where Wednesday’s session was defended rather well and strong each time it pushed there.

Volume Profile & Trends

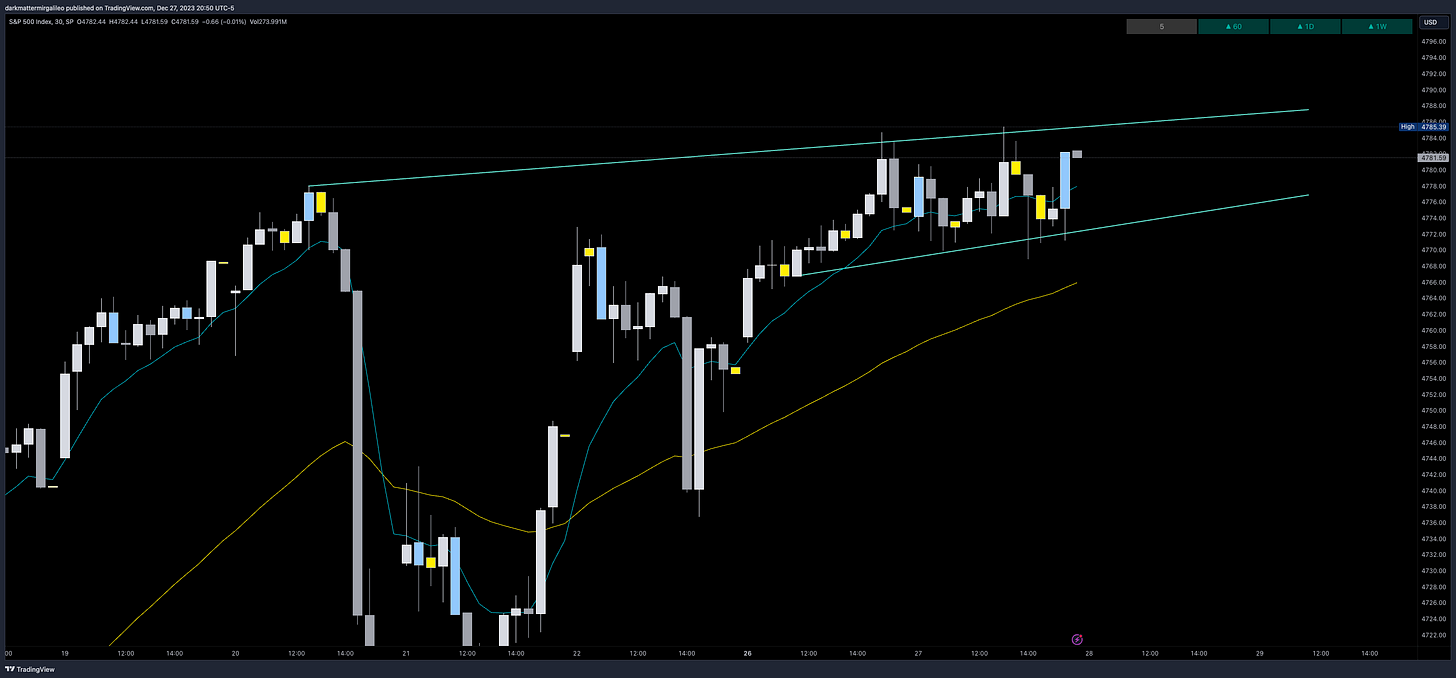

Here is the trend I am watching on SPX…

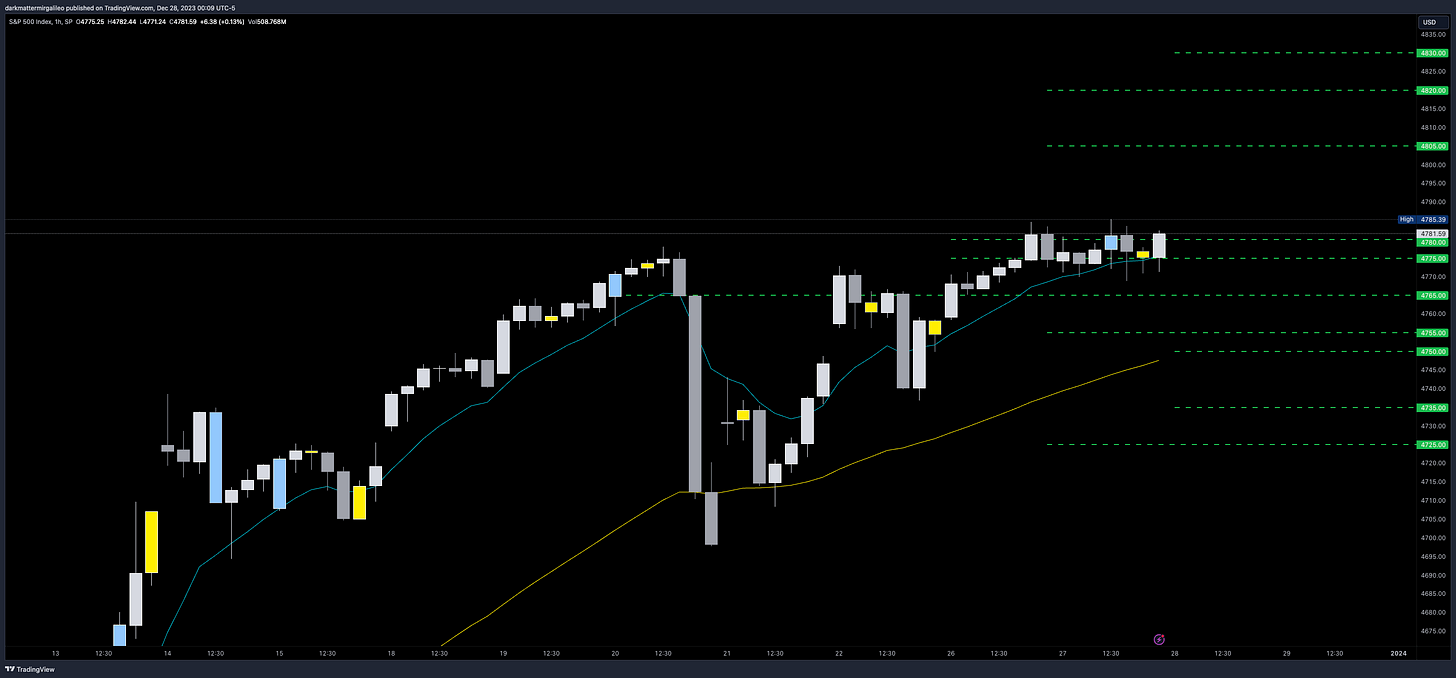

From a quarterly volume profile on the weekly chart some key levels are seen.

4687 - 2021 POC

4684 - Q4 2021 POC

4655 - Q4 VAH - still forming

4556 - Q4 POC - still forming

4537 - 2023 VAH

If we take a look at the daily chart and review the monthly volume profile we find the following levels…

4818 - January ‘22 VAH

4786 - January ‘22 POC - hasn’t been breached

4784 - December's VAH - still forming

4719 - December's POC - still forming

4603 - December’s VAL - still forming

Let’s now look at the 4hr chart and review what the weekly volume profile levels show.

4818 - All Time Highs

4785 - Weekly High

4780 - 12/26 Weekly VAH

4769 - 12/26 Weekly VAL

4758 - Weekly Low

4740 - 12/18 Weekly POC

4722 - 12/18 Weekly VAL

4697 - Previous Week Low

On the smaller timeframe and intraday let’s go to our 30min chart where we will put our session volume profile on. Our levels of importance are…

4785 - Previous Session High of Day

4783 - 12/27 VAH

4774 - 12/27 VAL

4768 - Previous Session Low of Day

4767 - 12/26 VAL

4752 - 12/22 VAL

4728 - 12/21 VAL

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4805 - negative vanna

4820 - negative vanna

4830 - negative vanna

4880 - negative vanna

Below Spot:

4780-4775 - negative vanna

4765 - negative vanna

4755-4750 - negative vanna

4735 - negative vanna

4725 - negative vanna

Orderblocks (OB)

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4774-4808 - OB (1hr, 2hr, 4hr chart)

4791 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4766-4736 - OB (4hr chart)

4751 midline

4758-4749 - OB (2hr chart)

4754 midline

4735-4708 - OB (2hr chart)

4722 midline

4718-4712 - OB (15min chart)

4715 midline

Overlay of Key Levels

Above Spot:

4780-4786 - Chop Zone

4783 - 12/27 VAH

4784 - December's VAH - still forming

4785 - Previous Session High of Day

4785 - Weekly High

4786 - January ‘22 POC - hasn’t been breached

4774-4808 - OB (1hr, 2hr, 4hr chart)

4791 midline

4805 - negative vanna

4820 - negative vanna

4818 - All Time Highs

4818 - January ‘22 VAH

4830 - negative vanna

Below Spot:

4780-4775 - negative vanna

4780 - 12/26 Weekly VAH

4774 - 12/27 VAL

4765 - negative vanna

4768 - Previous Session Low of Day

4769 - 12/26 Weekly VAL

4767 - 12/26 VAL

4766-4736 - OB (4hr chart)

4751 midline

4755-4750 - negative vanna

4758 - Weekly Low

4752 - 12/22 VAL

4740 - 12/18 Weekly POC

4735 - negative vanna

4728 - 12/21 VAL

4725 - negative vanna

4722 - 12/18 Weekly VAL

4719 - December's POC - still forming

Weekly Option Expected Move

SPX’s weekly option expected move is ~57.62 points. SPY’s expected move is ~5.92. That puts us at 4812.26 to the upside and 4697.02 to the downside. For SPY these levels are 479.54 and 467.70.

Remember over 68% of the time price will resolve it self in this range by weeks end.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.