February 20, 2024 SPX, ES, SPY Trade Plan

Weekly Market Overview

Hello team. We made it past OPEX and with it ahead of what most others were able to do as I saw in Twitter/X some folks hurt by the rug pull on SMCI and the indices giving great ranges is still trading sideways in between 5050 and 4920. On multiple occasions during the week this 5030-5050 zone became a major resistance level - where on Friday it sent the price in the last 2 hours 38 pts down.

From Friday’s trade plan we immediately were presented with 2 great trade opportunities…

Below 5020 target 5010

If VIX continues going up then a breakdown of 5010 targets 5000

It was then at 10am when additional news came out on consumer sentiment and inflation expectations that we were able to find a base and 0DTE options flow shifted in favor of the bulls pushing price back to 5040.

On a day where we have news at 10am and a trade idea occurring you should stick to the trade plan and execute your trades, but manage your risk. Within a half hour you had a 20pt move on the SPX and your trading day could have been done from there. These levels we provide when they trigger they are areas of liquidity, not a lot of bears or bulls fighting as price is not interesting to them there. While yes I prefer to wait, levels are levels and they will trigger reactions.

Additionally, what else was interesting in the markets was the continued weakness and sector rotation out of tech. Massive red day with SMCI, AAPL, ADBE, MSFT, META, GOOGL, and so forth.

This week the most volatile event we have is the Wednesday FOMC Meeting Minutes and on Thursday we have PMI. A few FED speakers sprinkled in between throughout the week highlight our news events.

For our free trial subscribers you have had a sneak peek into our daily trade plans and more importantly our intraday trading/chat room.

Don't miss out on these trade plans and intraday updates for as low as $15/month! At the end of this month prices will increase to $29.99/month.

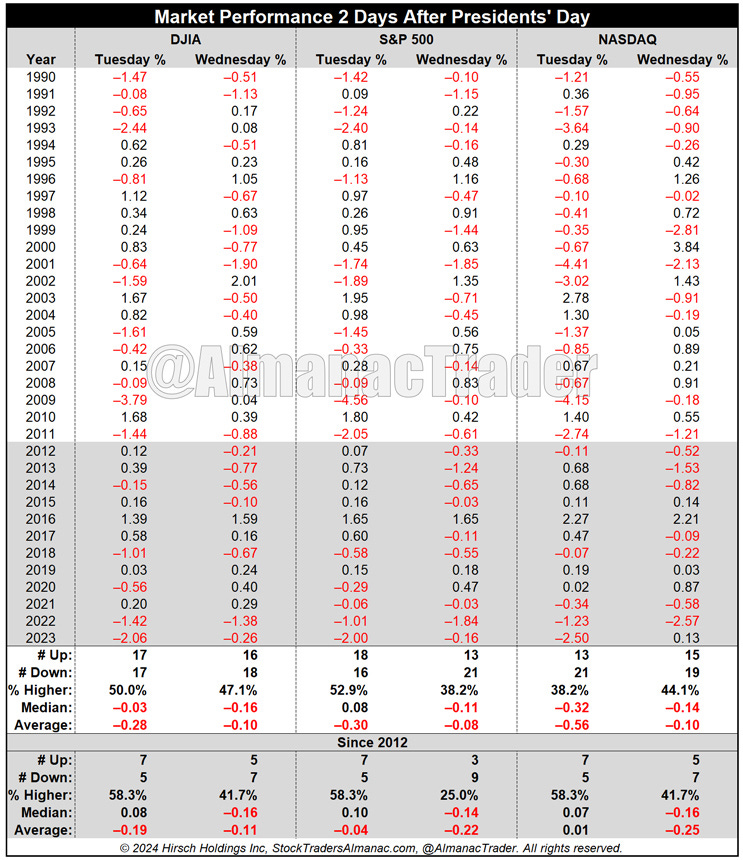

That is less than 30 cents a day! Don't miss out before prices go up!An interesting stat here. The week after Feb OPEX over the past 30 years has yielded a week ending 14 times up and 16 times down for an average move of -0.72%.

Typically, what we see is sideways chop Tuesday followed by a selloff Wednesday.

To further add to this bearish view here is a study from Wayne Whaley…

Last 50 yrs, there have been 29 in which Feb Opex and Pres Day coincided. The Nasd was 7-22 in the 3 days after for avg 3 day loss of 0.69%. If prior wk was neg, Nasd 1-11 on that Tuesday, avg -1.04%. 1% moves for S&P and Nasd, combined 0-16 on Tuesday.

2/20 News Catalysts

For more information on news events, visit the Economic Calendar

February’s trading session seasonality…it starts to get sluggish going forward…

It tracks with the larger yearly season calendar during an election year.

Just a reminder for those not subscribed to our monthly or yearly paid subscription the newsletter will end here for you. You can still join us for the rest of the plan where we discuss key levels and entries to take and targets. Subscribe below.