January 25, 2024 SPX, ES, SPY Trade Plan

Market Recap

Hello team. Not enough time to do a recap so lets jump into the trade plan for tomorrow. For those not subscribed our team nailed the top to 4900 before we started to experience a sell off. With TSLA ER’s out of our way the big news impact will come Friday with PCE…

Our free preview to our chat room expired on Friday. For those in the chat room we triggered longs on Friday and use our chat room for intraday updates and targets as 0DTE options come on.The BPSPX held it’s line today at the 50MA. It’s starting to weaken and a break of this will push risk on equities like the SPX down. So keep an eye on it…

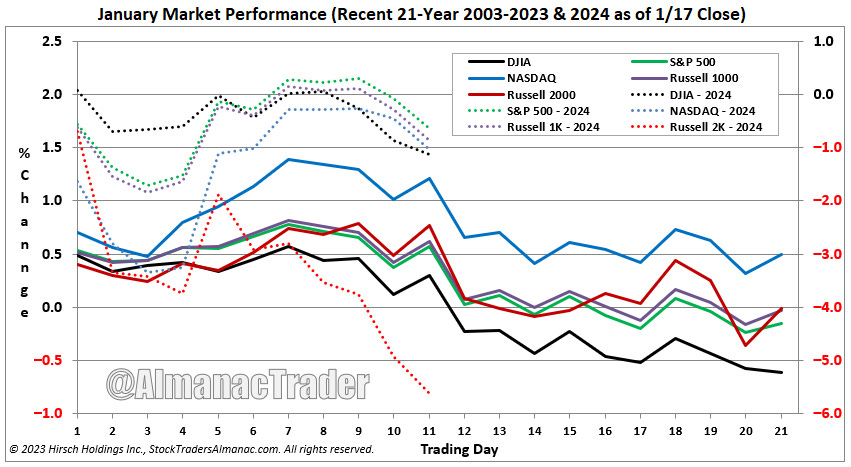

Here is a seasonality chart day-by-day of the trading sessions in January…

So far on the month the SPX is up 2.07%…

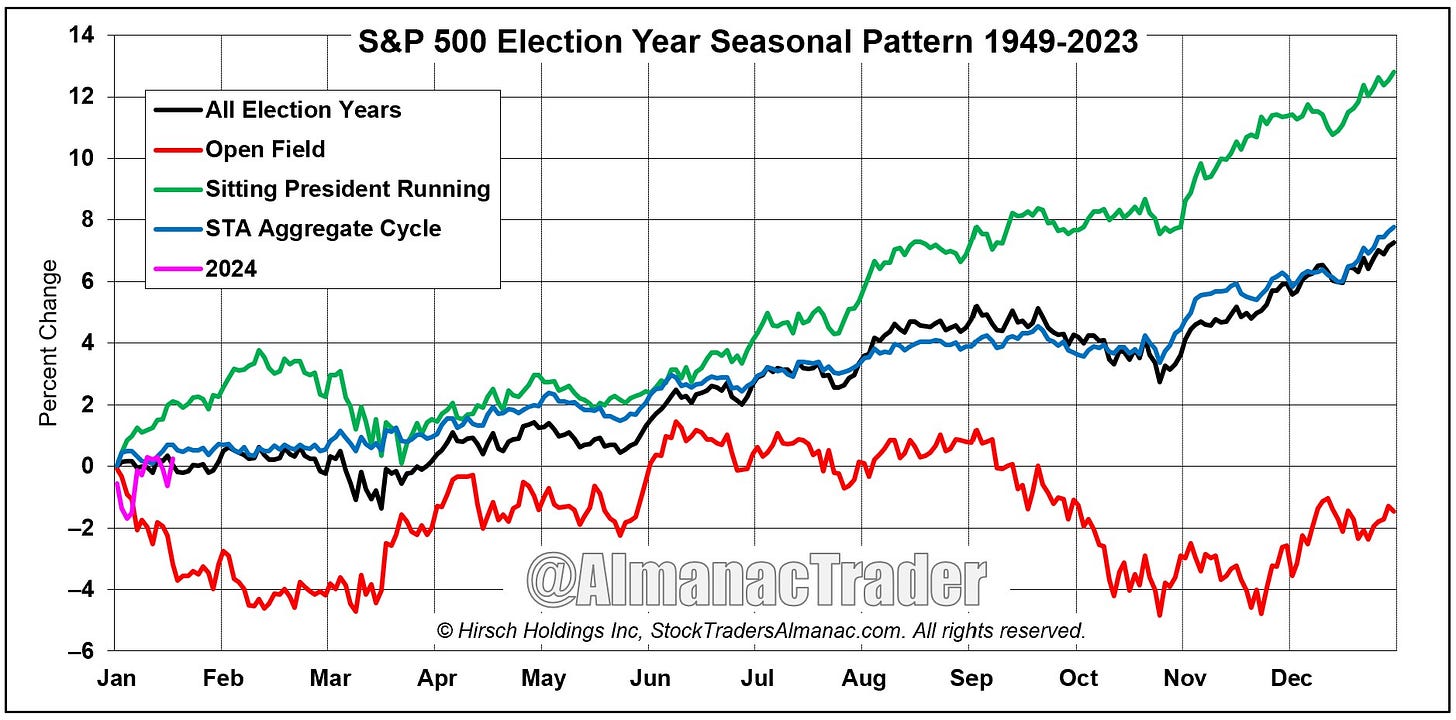

What we have to keep in mind with some of these seasonality charts is that we are in an election year. Seasonality instead looks like this which is another 2ish percent up from now until early/mid February before we then get a selloff going into March which negates the gains we make in January/February…

We will continue to monitor some of these seasonality views. There are a few of them out there and it will be important to see how the month ends to give us more insight into which seasonality chart it follows.

Just a reminder for those not subscribed to our monthly paid service the newsletter will end here for you. You can still join us for the rest of the plan by subscribing below.