January 26, 2024 SPX, ES, SPY Trade Plan

Market Recap

Hello team. Futures action is moving quite fast today where we have price heading to testing our lows of yesterday’s session. Currently price is contained within 4845-4900. This zone will dictate which way/direction/leg we trade next.

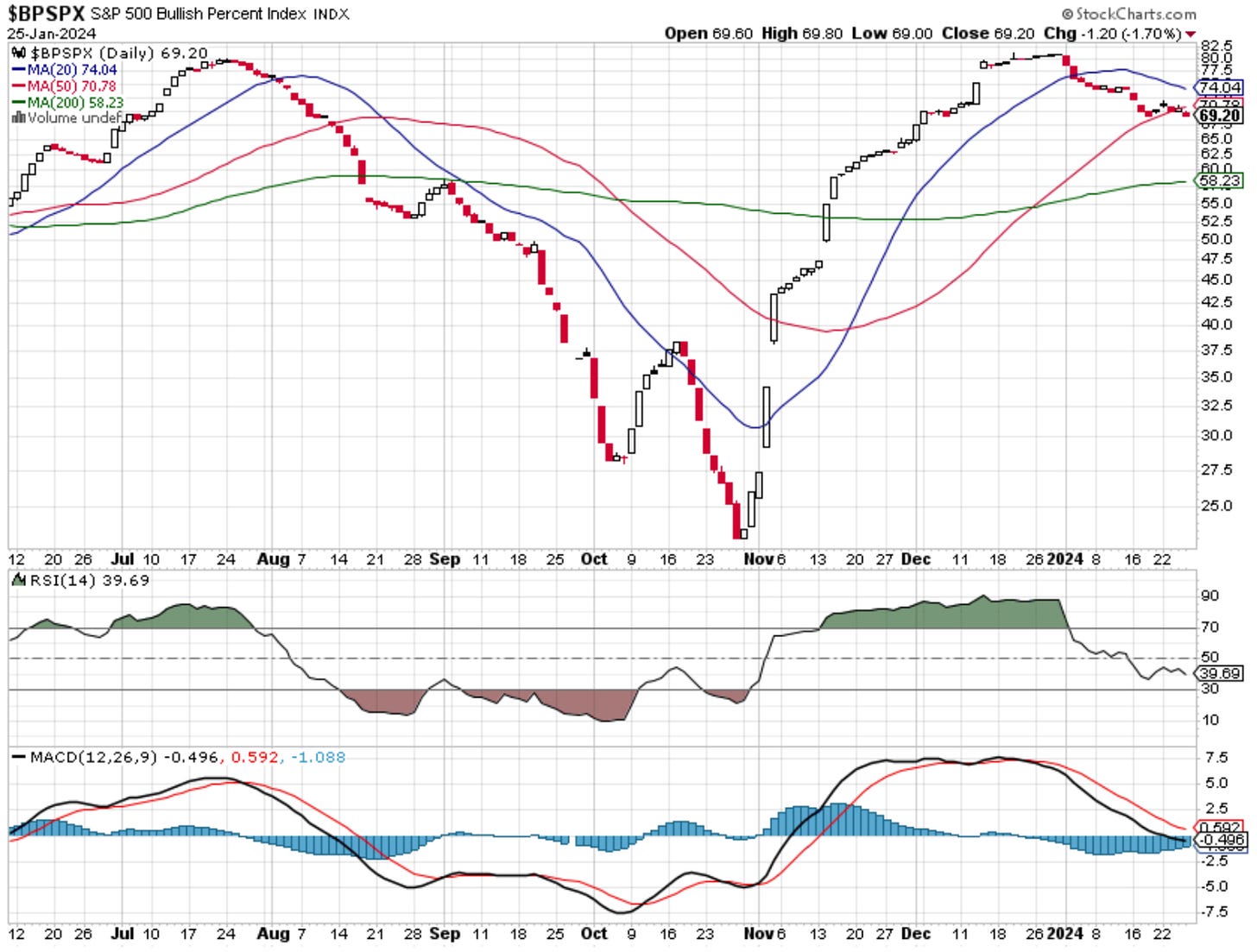

The BPSPX broke below its 50MA. This is a great first sign. We know need to see how the market starts to react and if we start to see a bit of weakness in it over the next week.

The new AAII Investor Sentiment Survey came out and we are seeing over the past month the bullish sentiment reduce with another reduction this week.

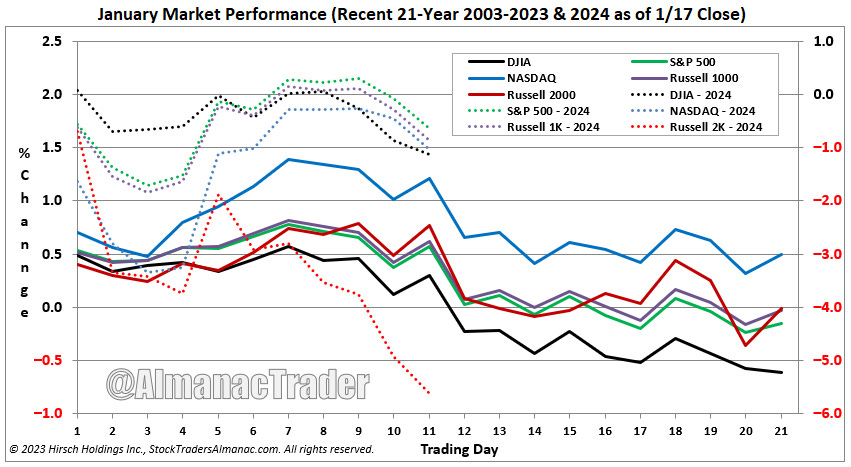

Here is a seasonality chart day-by-day of the trading sessions in January…

So far on the month the SPX is up 2.61%…

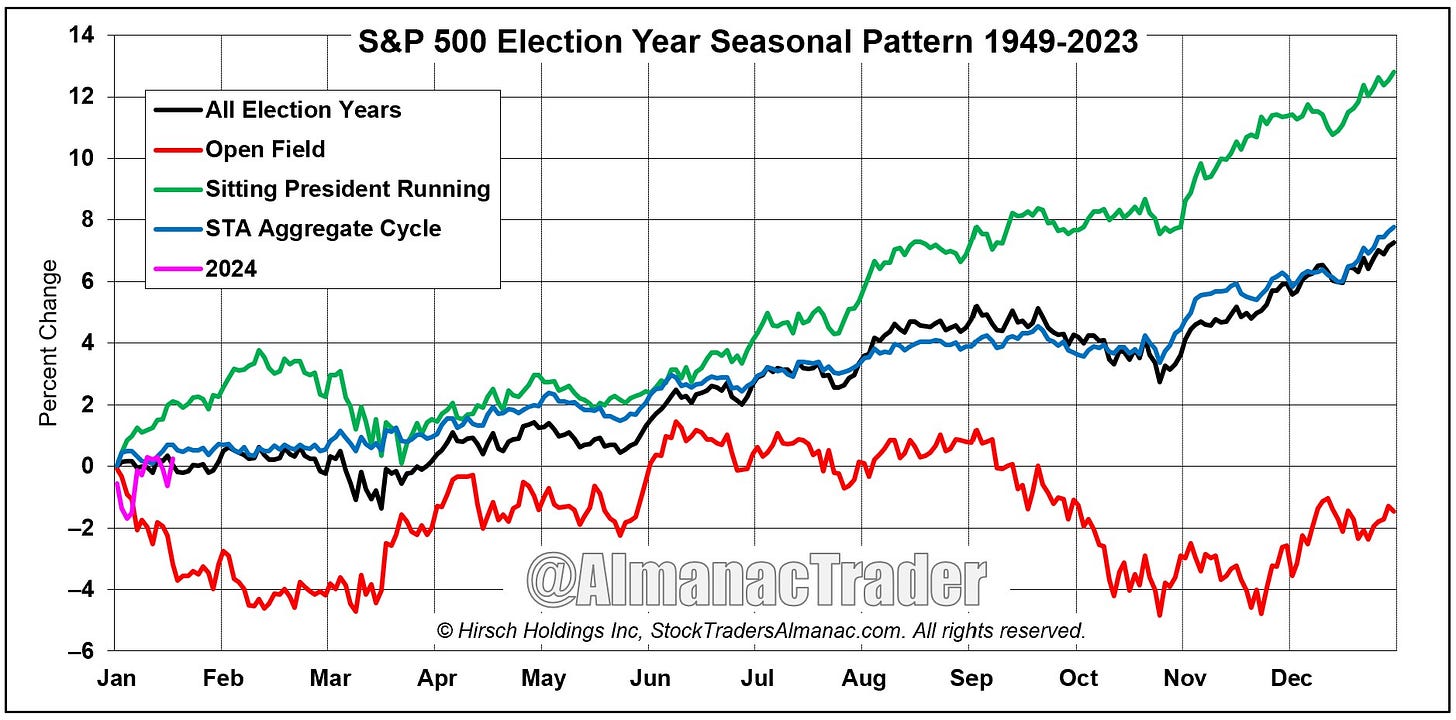

What we have to keep in mind with some of these seasonality charts is that we are in an election year. Seasonality instead looks like this which is another 2ish percent up from now until early/mid February before we then get a selloff going into March which negates the gains we make in January/February…

We will continue to monitor some of these seasonality views. There are a few of them out there and it will be important to see how the month ends to give us more insight into which seasonality chart it follows.

Just a reminder for those not subscribed to our monthly paid service the newsletter will end here for you. You can still join us for the rest of the plan by subscribing below.